Roi on investment property

The result of this program is a 200000 growth in profits over each of the following two years. They will then build an investment plan that fits your needs.

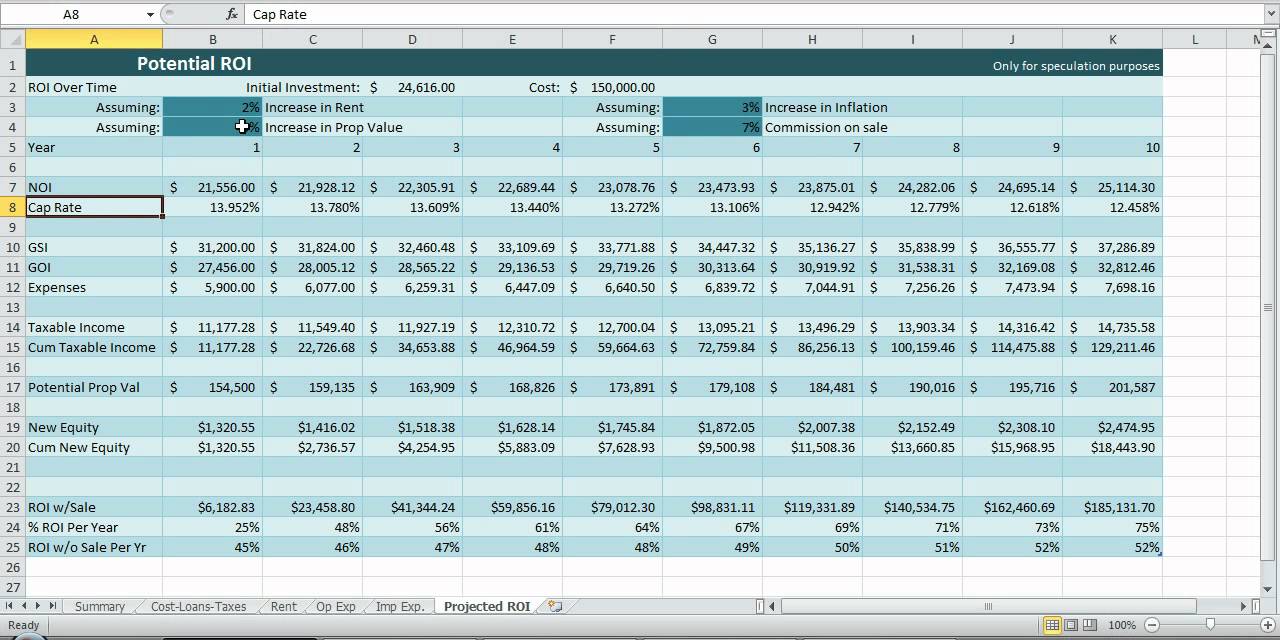

Rental Property Roi And Cap Rate Calculator And Comparison Spreadsheet Template

ROI is your cash flow relative to the cost of your investment or your basis Mathematically that would be.

. Rental Property ROI Calculation. In above question I forgot to state that owner will pay the 500K back as well as 40 of the appraised increase in the property value. Real Estate Investment Calculator.

Top 5 Benefits Of Using A HELOC For Investment Property. The higher the percentage the greater the return on investment. So the return on your investment for the property is 50.

When investing in a rental property the amount of money coming in and going out ie. Check with your local records office for more comprehensive detailed information. This ROI calculator return on investment calculates an annualized rate of return using exact dates.

Return on investment ROI from a rental property is more commonly referred to as rental yield. The capital appreciation of the property after selling costs has increased by 3 equaling R30 900 R1 060 900 R1 030 000 To calculate the propertys ROI. Return on investment ROI is a metric that helps real estate investors evaluate whether they should buy an investment property and compare apples to apples one investment to another.

If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI. What is ROI. The rental property ROI calculation can generally take two forms depending on whether you purchase your property with cash or.

To calculate the cap rate you divide the net. The monthly revenue will be the cash received each month by renting out the property. More Info First Time.

Property details should be available from the seller. Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. An investor purchases property A which is valued at 500000.

The cap rate does not include financing which is what differentiates it from the effective return on investment ROI it is how you analyze a property based on non-mortgage expenses and income. So a 100000 property that needs 50000 in work would need to rent for at least 1500 per month to make sense not 1000 If a property passes the one-percent rule its worth considering. Analyze the value of purchasing an investment property or renting your home or condo with the calculator below.

Return on investment ROI is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. Add your information in the green boxes to instantly calculate the ROI cash flow and IRR. ROI is calculated by dividing the annual income by your total investment.

Thankfully the experts at FortuneBuilders have everything you need to know about how to buy investment property in 2022. It is most commonly measured as net income divided by the original capital cost of the investment. ROI measures the amount of.

The Capital ROI Return on Investment here is the annual percentage change determined by Percent Change in Total Investment REG Distributed Years Since Prior Valuation. ROI which stands for return on investment is the probability of gaining a profit from the total money invested. When it comes to financial stability both homeowners and investors should be prepared with a plan.

As a marketing manager in a large international company you introduce a new marketing program with a budget of 250000. To calculate your ROI on potential property investments follow these steps. Additionally if you have a mortgage on your rental property you need to include your debt payments cash down payment and closing costs into your rental property ROI calculation.

A new roof can increase home value but you might not see a 100 return on investment very few improvements if any offer a full recoup of money spent. We will assume a value of 1400 per month on this property cell D22If you are charging for any other amenities like parking cleaning services landscaping fees etc we will catalog that value as Other Income cell D23. Buying investment property can be confusing for beginners.

Bobs ROI on his sheep farming operation is 40. You must consider the rate of returnalso known as return on investment or ROItoo. The ROI can be found by dividing your annual income by the total investment and the cash flow is the amount of money you will make from each of your assets.

Divide the annual return R96 000 R30 900 R126 900 by the amount of the total investment R1 03 million ROI R126 900 R103 million 0123 or 123. A Property Fit expert will work with you to understand your property investment requirements and what you want to achieve. As return on investment ROI is sometimes confused.

We will leave this at 0 zero for our example. The Return On Investment ROI Is There. Calculates adjustments required to achieve goal ROR.

More Info 11 ROI. More Info 9 ROI. Investing with RealT means low maintenance property ownership access to cash flows related to the property eg rent and frictionless ownership transactions.

ROI allows investors to predict based on comparables the profit margin they should realize on their real estate either through flipping homes or renting properties. Put simply rental yield is expressed as a percentage measuring the difference between the income received from tenants and the overall costs of your investment. Years Purchase YP single rate or the Present Value PV of 1 per annum receivable at the end of each year after accounting for a sinking fund to accumulate at the same rate of interest as that which is required on the invested capital and ignoring the effect of income tax on that part of the income used to provide the annual sinking fund instalment.

There are many factors but a quick calculation of your Return on Investment ROI and Cash Flow will help you evaluate whether a property will make an excellent rental investment. The cash flow may provide a net gain or lossThe goal of rental property investing is to generate a positive cash flow so the amount of money earned. If your rental income is 15000 and you paid 150000 for the property your ROI is 10.

June 30 2020 at 629 pm. Whether it is a investment property or a home you will come back to someday we will ensure that it is properly managed to make sure it. Real estate investors often see positive cash flow with their investment properties in todays market but the savviest investors calculate their approximate return on investment ROI rates before they purchase a property.

ROI Property Management specializes in residential commercial and HOA property management in the mid-atlantic area. But even if you dont see a huge financial return a new roof can make you more likely to get full asking price lower time on market and smoother negotiations. The cap or capitalization rate is the rate of return that is expected on a rental property investment.

Two years later the investor sells the. Using the equity in a home or investment property to pay for home upgrades or cover unexpected expenses in the form of a HELOC can be a great option for financially healthy individuals. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments.

Adjust any of the inputs and the results will instantly update to reflect the changes. Return On Investment - ROI.

How To Increase The Roi Of Your Real Estate Investment Portfolio Epic Real Estate I Investissement Immobilier Locatif Immobilier Locatif Conseils Immobiliers

Cash Flow Analysis Worksheet For Rental Property Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

Turnkey Rental Property Actual Numbers And Roi Rental Property Rental Property Investment Investing

Pin On Real Estate

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

My Seven Step Process For Buying A Rental Property Addicted To Roi Buying A Rental Property Property Real Estate Rental Property

Rental Property Investment Calculator Roi Noi And Cap Rate Analysis Google Sheets Excel Versions Digital Download

Investing Rental Property Calculator James Baldi Somerset Powerhouse Re Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Cool Infographic About Real Estate Cash Vs Leverage Property Roi Explained Real Estate Infographic Finance Investing Successful Business Tips

Investment Property Spreadsheet Real Estate Excel Roi Income Noi Template Youtube Real Estate Investing Books Investing Books Investing

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

Buy To Let Property Investment Taking You The Next Step Rental Income Investing Definitions

Pin On 5 Unit Rental Property Template

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

How To Calculate Roi On Rental Property Investments Homeunion Rental Property Investment Investment Property Rental Property

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Investing Rental Property Management

What Is A Good Return On Investment Investing Investment Property Real Estate