W4 withholding calculator

Your tax liability is the amount of money that you owe to the government in federal. Get your taxes done.

Excel Formula Income Tax Bracket Calculation Exceljet

Afraid You Might Owe Taxes Later.

. Ask your employer if they use an automated system to submit Form W-4. Ad Are You Withholding Too Much in Taxes Each Paycheck. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

It is important that your tax withholding match your tax liability. The calculator helps you determine the recommended. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help.

November 25 2020 930 AM. Last updated November 25 2020 930 AM. IR-2018-36 February 28 2018.

IRS tax forms. Ad Access Tax Forms. With the results from the withholding calculator you can complete a new Form W-4 to change how much of your paycheck is withheld for tax purposes.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Submit or give Form W-4 to your employer. Were about to look at the need-to-know for the W-4 form and provide you with our W-4 calculator so you can make sure youre on the right path.

To keep your same tax withholding amount. Any results this calculator yields will be. 250 and subtract the refund adjust amount from that.

Then look at your last paychecks tax withholding amount eg. You dont need to. 250 minus 200 50.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck. Use this IRS calculator tool for the year ahead to determine how to complete Form W-4 so you dont have too much or too little federal income tax withheld. Complete Edit or Print Tax Forms Instantly.

That result is the tax withholding amount. Enter YTD data for increased. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

W4 Calculator Adjust payroll withholding throughout the year FEATURES. Up to 10 cash back Maximize your refund with TaxActs Refund Booster. The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund.

Projects taxable income and calculates required withholding allowances. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. H and R block Skip to.

The sooner you submit.

Tax Withholding For Pensions And Social Security Sensible Money

Federal And State W 4 Rules

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Calculate Federal Income Tax

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Federal Withholding Tax Youtube

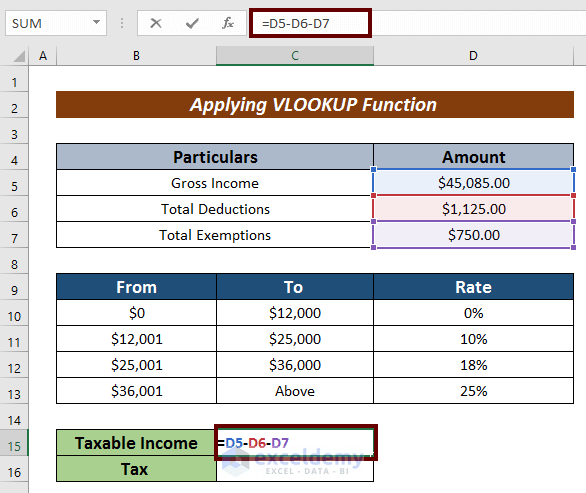

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculation Of Federal Employment Taxes Payroll Services

United States W 4 Allowances Irs Calculator Personal Finance Money Stack Exchange

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Irs Improves Online Tax Withholding Calculator